The government of Kenya is contributing actively to the momentum around electric mobility as a cornerstone of global decarbonization. Kenya was among the few developing countries that signed the “COP 26 declaration on accelerating the transition to 100% zero-emission cars and vans”. However, with less than 0.1% of the current vehicle fleet being electrified, the country is still far off from getting to this target. Still, such commitments from Kenyan authorities signal political goodwill and interest in electrifying the transport sector.

Transitioning to just and sustainable mobility requires more action than electrifying the transport system. We need a combined approach that isn’t limited to electrification but also includes promoting active mobility, mass transportation, public education and other innovative technologies.

In light of the developments at COP 26, this article will, however, shine a spotlight on electric mobility in Kenya, taking cognisance of the fact that the other measures are just as significant.

For the larger part of 2020, GIZ Kenya through the Advancing Transport Climate Strategies (TraCS) project, supported a study commissioned by the State Department for Transport to assess the regulatory environment for e-mobility in Kenya. Strathmore University conducted the study in cooperation with Knights and Apps Ltd.

The assessment looked at the following three aspects:

The assessment was informed by expert interviews as well as official government documents and secondary resource material.

In 2020, the number of registered vehicles in Kenya was at 3.95 million; out of this, roughly 50% (1.97 million) were motorcycles and tricycles. The data from the Kenya National Bureau of Statistics (KNBS) indicates that motorcycle registration over the past few years has been increasing at an exponential rate and that it has recently surpassed “motor vehicles” (i.e., passenger cars and commercial vehicles). About 176,000 motorcycles are registered annually compared to 99,000 motor vehicles. Since Kenya does not de-register vehicles, it is currently not possible to precisely estimate the number of vehicles that are still in use (in-service vehicles). In a study commissioned by TraCS and conducted by the University of Nairobi, the share of in-service fleet was estimated to be about 63%- 69% for all vehicles registered between 1985 and 2016.

Based on official data from the National Transport and Safety Authority (NTSA), a total of 671 electric vehicles are registered in Kenya. Motorcycles make up the biggest share (at 324). In addition, 105 electric three-wheelers and 128 electric motor vehicles are currently registered. The remaining vehicles fall under “other” vehicle categories.

Kenya has seen an influx of hybrid vehicles with a few of them being plug-in hybrids (particularly the Mitsubishi Outlander). It is, however, not possible to determine the exact number of imported hybrid vehicles. This is because of the vehicle categories that registration is currently based upon. Vehicles are registered based on their primary fuel type. Registration categories that capture the hybridization type (i.e., plug-in hybrid, battery electric vehicle, among others) as well as battery size, electric motor power rating etc, are not captured. The authority responsible for vehicle registrations has indicated openness to taking this up and to further enhancing the level of details recorded.

The authors of the study recommend expanding the registration system and template to include electric vehicle details beyond fuel type (power source). The proposed template for such an expansion of registration categories can be found here.

Vehicle taxation in Kenya is based on four areas:

The year of manufacture (and registration in a different country) is relevant for calculation of the imported vehicle tax.

The total tax for imported vehicles is calculated as follows:

The customs value is generated from the year of manufacture where a depreciation rate is generated, and from the current retail selling price (CRSP) which is provided by a licensed local dealer or a vehicle manufacturer. For instance, the CRSP for a 2013 Nissan Leaf in 2020 was KES 4,810,550 (around USD 42,327) in comparison to a Toyota Premio of the same valuation (at port of export) whose CRSP was KES 2,704,600 (around USD 23,797). The customs value of the Nissan Leaf is KES 810,198 (around USD 7,128) while that of the premio is KES 379,593 (around USD 3,340). Basically, EVs are allocated a comparatively very high CRSP causing a disproportionately high vehicle tax value.

In 2019, the government of Kenya halved the excise duty paid on imported electric motor vehicles from 20% to 10%. The study could show that the impact on EV price competitiveness remained negligible even after the duty was reduced. More incentives are still needed for the final price of an imported EV to be competitive with conventional ICE vehicles in Kenya.

It is currently not possible to use the Kenya Revenue Authority database to estimate taxation values for EVs as no electric vehicle model is included in the database. Including EVs in the database would hence go a long a way in making the zero-emission vehicle ownership much easier.

Further insights and recommendations on the taxation regime for electric vehicles can be found here.

Standards for road vehicles in Kenya are dictated by the Road vehicles – Road vehicle inspection – Code of practice KS1515. A typical inspection process covers an emission test that examines the carbon monoxide and hydrocarbon levels as well as the overall condition (primarily safety elements) of the vehicle. After inspection a road worthiness certificate is issued. In the latest update from 2019, more stringent measures were introduced such as banning the import of passenger vehicles larger than 7m. Also, the update incorporated preliminary guidelines on the inspection of electric vehicles.

In October 2018, the Kenya Bureau of Standards (KEBS) published 24 standards specific to electric vehicles. These were developed by the roads technical committee of KEBS, with support from GIZ and the UN Environmental Programme. The standards outline safety specifications for all electric vehicles in the country and define the operation and testing procedures to be used for manufactured electric vehicles. All of these standards were adopted from existing ISO standards. Hence, it is necessary to localise or contextualise the standards based on a deeper understanding of the Kenyan EV ecosystem. Further details on these standards can be found here.

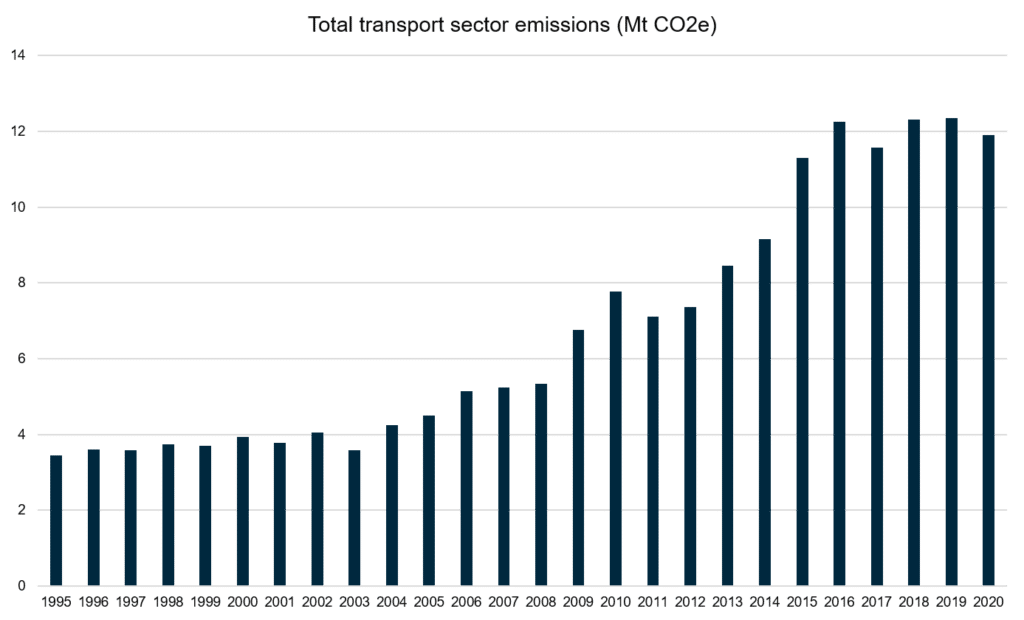

The transport sector emissions in Kenya were at 11.25 MtCo2e in 2015 (National Inventory Report 2020). This compares to 7.77 MtCo2e in 2010 and 12.34 MtCo2e in 2019 and 11.89 MtCo2e in 2020 (cf. figure 1).

Up until now, the government of Kenya has mainly focused on the mitigation benefits of e-mobility (estimated to be about 0.6 MtCO2e in 2030). However, the co-benefits are proving to be significant; particularly in terms of job creation. Estimates from a recent analysis conducted by UKAid’s Manufacturing Africa program in Kenya, 2021, reveals the revenue potential for electric two wheelers industry is ~$350m per year by 2030.

Overall, there is a very positive signal for e-mobility from the State Department for Transport; a process that will see the Government of Kenya develop a much-anticipated electric mobility policy has been initiated. This was one of the major recommendations from this study and is expected to provide much-needed regulatory guidance for e-mobility uptake in the country.

Further, the Kenya Bureau of Standards recently (November 2021) set up a technical committee that is specifically meant to provide standards for electric vehicles in Kenya (TC 197). The committee already had its first sitting and is moving forward with plans of developing standards for the Kenyan market. This committee is also expected to play a significant role during the development of the electric mobility policy.