The direction of countries’ COVID-19 recovery plans will determine the world’s climate and sustainable development trajectory for decades to come. These multisectoral investment programmes provide an important opportunity to support the economy and to simultaneously increase its environmental sustainability and resilience. Sustainable recovery plans are needed that align with countries’ climate ambitions as laid out in their Nationally Determined Contributions (NDC).

Against this background, GIZ together with SLOCAT and LEDS GP held a regional peer-to-peer exchange on “Using green recovery for fast-tracking NDC implementation in the transport sector in Asia”. More than a dozen officials from environmental and transport agencies from India, Thailand, Sri Lanka, Vietnam, Laos, Indonesia and the Philippines discussed with experts and how the transport sector is currently affected by the crisis and how economic recovery programmes can be designed to enhance NDC implementation in the transport sector. In particular, Mr. Amegh Gopinath from the Integrated and Sustainable Urban Transport Systems for Smart Cities in India (SMART-SUT) project gave an interesting input on the Impact of COVID-19 on Indian Cities and Mobility as well as on the Global Impact of COVID-19 on Cities and Mobility. Other presentation materials can be found here.

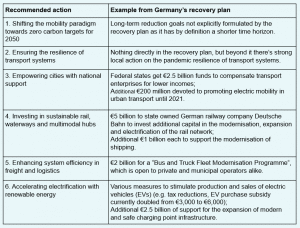

GIZ’s Programme Director for transport and climate change, Daniel Bongardt, presented the €130 billion German stimulus plan as a good practice example. He emphasised that Germany’s plan corresponds well with GIZ’s Six Action Recommendations for policymakers on how to align the transport sector with the Paris Agreement and the Sustainable Development Goals:

Aside from Germany, how about the rest of the world? Let’s look how other countries’ recovery plans correlate with each of our six recommendations:

Moving towards a net-zero transport system by 2050 is essential for reaching global climate goals. Spain’s plan for boosting the automotive industry refers explicitly to decarbonisation and the need to achieving climate neutrality by 2050 through an economic and technological transformation. In addition, the EU’s proposed recovery plan mentions the transition to climate neutrality and its 2030 climate targets. Other governments’ plans miss such long-term perspective, which may be due to their nature as more short-term stimulus plans. However, today’s investments in transport infrastructure should already be climate-sensitive to avoid lock-ins and stranded assets.

The transport sector is particularly vulnerable to climate change effects. Measures to strengthen its climate-resilience are still missing in the current recovery plans. However, transport is not alone in this regard. Climate adaptation and resilience have generally not been incorporated in governmental recovery plans. Therefore, the Global Commission on Climate Adaptation has called on world leaders to incorporate climate resilience into economic recovery packages, arguing that investing in climate resilience is smart economics generating high cost-benefit ratios.

In France, a €20 million fund was launched to support cycling when lockdown measures are eased, subsidizing bicycle repairs, cycling parking spaces and cycling training.

As part of the Polish recovery plan, the climate ministry gives a total of €90 million subsidies for electric buses. A share of €15 million finances electric school buses in rural areas (up to 95% of purchase price) and €75 million are dedicated towards urban transport companies (up to 80% of purchase price or granting loan).

Finally, the United Kingdom recently approved an approximately €275 million emergency travel fund to promote pop-up bike lanes, wider pavements, safer junctions, cycle and bus-only corridors and vouchers for bike repairs. Additionally, approximately €11 million enables local authorities to install up to 7,200 electric car chargers. An e-scooter trial will also be fast-tracked to assess the benefits of the technology as well as its impact on public spaces.

South Korea’s recovery plan announces 100 new IT-based systems to help resolve environmental issues, including low carbon vehicle manufacturing. A €4.7 trillion worth of spending in low carbon and distributed energy systems will include investment in cleaner ships.

In the UK, the government fast-tracked infrastructure renewal projects for railways (approximately €606 million) and roads (approximately €220 million).

The proposed European stimulus plan generally doesn’t yet include much sector detail, but there have been statements by EU officials indicating that a multibillion ‘Renaissance of Rail Investment package’ will be part of the EU’s green recovery effort.

France recently released a bailout package for the Air France-KLM Group that is tied to climate mitigation conditions. Among those are restrictions for domestic flights (no domestic flights where a rail alternative with less 2.5 hours travel exists) – which creates business opportunities for French railway operators.

Spain’s recovery package contains a short-term renewal of the vehicle fleet of the General State Administration for vehicles with vehicle labelling requirements . It also includes loan guarantees for commercial fleets to finance the renewal of vehicles for professional use. Moreover, it entails a plan for requalification and updating of professional qualifications in the sector, especially promoting training for new technologies, digitization and sustainable means of transport.

China extended its subsidies and tax reductions for electric cars until the end of 2020. Further, China plans to expand the country’s charging network by 50% this year to stimulate electric vehicle deployment.

In France, the automotive stimulus package includes increased subsidies for buyers of electric or hybrid cars and support for research into hydrogen power. However, cars with combustion engines also qualify for a subsidy if the buyer can demonstrate that the new car emits less than the old one.

In Italy instead, while the stimulus package does not specify yet dedicated transport actions, it tops up the existing ‘Ecobonus’ scheme which effectively pays homeowners for green building investments incl. EV charging stations by funding 110% of the renovation costs (up from a previous 50%).

The Spanish government has announced a €3.7 billion to promote the production and sale of cleaner cars. €250 million will be spent on cash-for-clunkers schemes to encourage buying new low-emission and electric cars (€4,500 subsidy when scraping a 20-year-old car). Besides, the automotive industry will receive up to €415 million in grants for innovation and new automotive technologies.

The EU recovery plan proposes that the Connecting Europe Facility, InvestEU and other European funds “will support the financing of the installation of one million charging points, clean fleet renewals by cities and companies, sustainable transport infrastructure and enable the shift to clean urban mobility”. The Strategic Investment Facility is expected to “invest in technologies key for the clean energy transition, such as renewable and energy storage technologies, clean hydrogen, batteries, carbon capture and storage and sustainable energy infrastructure”. Moreover, the work of the European Battery Alliance will be fast-tracked.

Despite these positive examples, some countries’ recovery plans clearly lack transport decarbonisation measures or even contain incentives fostering a “brown recovery”.

Although being fairly comprehensive compared to other countries, the German package does not entail support for walking and cycling measures. Further, the plan’s most important instrument to stimulate short-term national consumption, the six months reduction of the VAT (19% to 16%, 7% to 5%), also applies to transport-related products and services, without taking into consideration their impact on the environment and climate. Additionally, the German government’s €9 billion bailout package for German carrier Lufthansa does not come with any climate conditions.

Italy is also planning a vehicle scrapping scheme for buyers of the latest generation cars (“Euro 6”), but the measure is limited to ICE vehicles.

In the US instead, the Senate approved an approximately €1.7 trillion rescue package setting aside l oans for airlines, air cargo carriers and airline contractors, which are not conditioned to sustainability requirements.

All around the world, governments are working on their COVID-19 recovery plans. Many stress the need for a “green recovery” and contain actions towards that end. However, there also examples without climate actions for transport.

Overall, there is a strong focus on the automotive industry, with many of the measures supporting transition to low and zero-emission vehicles. However, little attention is drawn towards climate action in the freight sector. Also cycling should be considered more (even though it is a hot topic at city levels). Adaptation measures are not an explicit motive in any of the examined plans.

If a government looks for advice on what to do for a green recovery of the transport sector, our six action recommendations turn out to be a good starting point.